Saving for life, as far as finances go, can be tough. We know that there are many annual expenses to save for, but because their “due dates” come at different times of the year, it can be hard to truly plan for each.

What do we do about Christmas? Dave Ramsey, an American personal finance personality, reminds his listeners often that Christmas comes EVERY YEAR. So why are we so surprised by it?

What do we do about our pet’s annual exam? Our car registrations? Taxes? They come every year also, and yet, we scramble to find the money to pay for them.

Since we know that each of these expenses comes at least once a year, we can in fact PREPARE for them.

Let me be clear. At first, it was a blurry line for me as well. I knew that I as the head of the Kurovski accounting department 🙂 wanted to plan ahead for these, but I couldn’t seem to figure out how to plan for the different monetary amounts that needed to go in and out of my account each month.

So, I talked to my sister, Kelsey Bankey, who is a certified financial planner with Sterk Financial Services and she suggested opening separate savings accounts for each category.

DUH! That makes total sense! But won’t the banks fine me for having so many savings accounts? NOPE! Well, at least many of them don’t as long as you follow the very basic rules of each savings account, which is usually something like…”Don’t withdraw money more than six times a month from the account.” This specific one shouldn’t be an issue since you are using these accounts for savings only and may only withdraw money from them once a month or even once a year.

With all that being said, here are the FOUR SAVINGS ACCOUNTS that made all the difference in our finances!

#1 General Savings Account

I like to always have one general savings account open for emergency situations. It is recommended that you save up to 3-6 months of expenses in your emergency account. Once you reach this amount, you can stop contributing.

#2 Vacation Account

Everyone wants to be able to vacation at some point or another. Your idea of a vacation could be a weekend getaway or a trip to Ireland. Either way, vacationing costs money. I like to have a separate savings account set aside for vacation funds so that I know I have the money to travel. It’s amazing how good it feels when you can use “vacation” funds for your vacations. It is almost as if the world is saying, “Go ahead! Use it up! You already have the money saved so go and have fun!!!”

#3 Christmas Savings Account

As I said before, Christmas comes EVERY YEAR and I absolutely despise the financial stress that can come with the holiday, or ANY holiday for that matter. Look through your year and decide which holidays you want to save for and keep all of that money in this account throughout the year. Only pull it when it is time to purchase food, presents, etc. for each specified holiday that you celebrate.

#4 Annual Needs Account

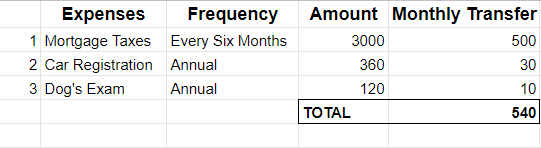

This one is somewhat of a hodgepodge of any financial obligations you have throughout the year. For our family, I saved for situations like our dog’s annual checkup, mortgage taxes, my car registration, a quarterly car service, etc. All of these obligations come up at different times of the year, but with this account, you can feel confident that you will have the money for each of these as long as you plan them into the budget for this account.

How do you feed these accounts?

In order to have appropriate funds for each of these financial events, you need to feed each savings account monthly. To feed each account appropriately, you need to know how much you need to save for each financial situation. Then, divide that number by the number of months you have to save for that situation.

For example, if you know you need $800 extra dollars around Christmas time, you would take that $800 and divide it by 12. Thus, you need to have approximately $67 transferred from your main checking to your Christmas account each month. At the end of the year, you will have an extra $800 ready for you to use however you need.

The amount you need for vacations may vary from year to year. If you know for sure that you have a trip planned in two years that will cost $3000, you can start planning for that now by transferring $125 (3000 divided by 24) into your account each month for the next 24 months so that when the trip arrives, you are prepared and not going into debt to pay for it.

Identifying the amount you need to pull each month for your Annual Needs Account is going to be a bit different. You will need to decide the monthly need for several expenses, so your contributions to this account may look more like this.

Make sense?

What do I do if I can’t afford my monthly contributions to each of my savings accounts?

Make adjustments.

At the end of the day, if you can’t afford your monthly contributions to your savings accounts, then you CAN’T AFFORD your Christmas, vacation, etc. expenses for the year. You can alter some of these accounts like the vacation and the Christmas funds, but some others are necessary expenses like taxes and car registrations. So, make adjustments to the amount you are allotting for each OR find a way to make a little more income each month.

This may mean that you have to cut back on vacation spending until you can afford to allot the desired amount. You may also have to get more strategic with your Christmas spending by lowering the budget and shopping for deals. Or as mentioned, you could always try to find a part-time gig for the next few months to help you save for that vacation you desire so much.

At the end of the day…

These four savings accounts provide good insight into what you need and what you can afford. Your planning strategy may not be perfect the first year, but as you move forward, you can make adjustments that work best for you.

If you are anything like me and my family, you are going to love the stability that this saving method provides. You won’t have to stress about how to afford your vacations or other expenses because you will already have the money set aside for those situations.

Try it out!